Balancing Act: Navigating the Federal Budget in the USA

Navigating the Fiscal Landscape: Understanding the Federal Budget in the USA

Introduction to the Federal Budget

The federal budget in the United States is a comprehensive financial plan that outlines the government’s revenue sources, expenditures, and financial priorities. As a crucial instrument for economic governance, understanding the intricacies of the federal budget provides insights into the nation’s fiscal policies and their impact on various sectors.

Revenue Streams and Tax Policies

At the core of the federal budget are revenue streams, primarily generated through taxation. Tax policies, including income taxes, corporate taxes, and excise taxes, shape the government’s income. Understanding the interplay of tax policies with economic conditions is vital for comprehending the budget’s revenue side and its implications for taxpayers and businesses.

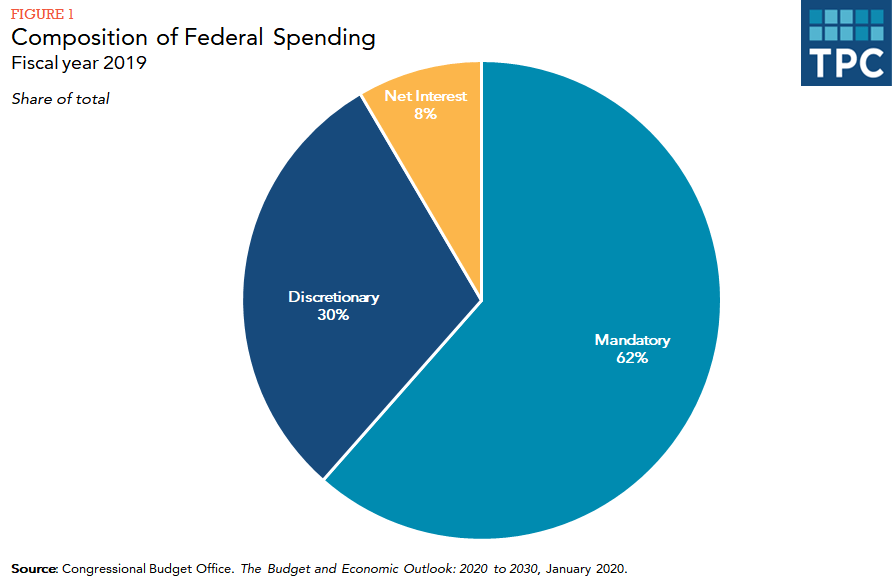

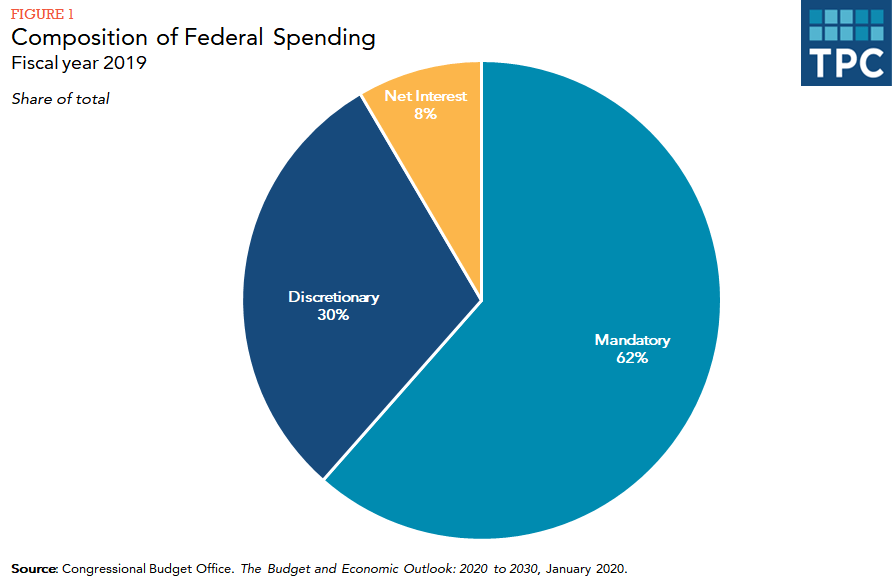

Expenditure Categories and Priorities

Federal expenditures cover a diverse range of categories, reflecting the government’s priorities. These may include defense, healthcare, education, infrastructure, social services, and more. Each category represents a portion of the budget, and understanding the allocation of resources provides insights into the government’s focus areas and policy objectives.

Budgetary Deficits and Surpluses

The federal budget can experience deficits or surpluses based on the balance between revenues and expenditures. A deficit occurs when expenditures surpass revenues, leading to borrowing. Conversely, a surplus arises when revenues exceed expenditures. Analyzing these budgetary dynamics provides a snapshot of the government’s fiscal health and its approach to managing finances.

Impact on the Economy

The federal budget wields considerable influence on the broader economy. Government spending stimulates economic activity, creating jobs and fostering growth. However, the size of deficits and the accumulation of national debt also raise concerns about long-term economic stability. Balancing these factors is a delicate task with implications for citizens, businesses, and the overall economic landscape.

Debt Ceiling and Fiscal Policy Challenges

The federal budget is intricately linked to the debt ceiling, a cap set by Congress on the amount of money the federal government can borrow. Discussions surrounding the debt ceiling often bring attention to fiscal policy challenges, prompting debates on spending priorities, taxation, and the overall financial health of the nation.

Government Accountability and Transparency

A transparent and accountable budgetary process is fundamental for democratic governance. Citizens, businesses, and policymakers rely on the federal budget for insights into how public funds are allocated. Transparency enhances public trust and ensures that citizens can actively participate in discussions about fiscal policies that impact their lives.

Long-Term Economic Planning

The federal budget serves as a tool for long-term economic planning. By outlining spending priorities, the budget provides a roadmap for addressing national challenges and achieving policy objectives. It reflects the government’s vision for economic development, social welfare, and overall national well-being.

Political Dimensions and Budgetary Decision-Making

Budgetary decisions are inherently political, reflecting the values and priorities of elected officials. The budgetary process involves negotiations, compromises, and strategic choices that shape the nation’s trajectory. Examining the political dimensions of budget-making provides insights into governance dynamics and the policy direction of the country.

Career Opportunities in Fiscal Management

For individuals interested in the fiscal management landscape, understanding the federal budget is essential. Careerth.com offers valuable resources and career opportunities in areas such as fiscal policy analysis, public finance, and economic planning. Visit Careerth.com to explore how you can contribute to the fiscal governance of the nation.

Conclusion: Navigating the Fiscal Terrain

In conclusion, navigating the federal budget in the USA involves comprehending the intricate balance of revenues, expenditures, and policy priorities. As a reflection of economic governance, the budget shapes the nation’s fiscal trajectory and influences the lives of its citizens. Understanding this fiscal terrain is crucial for informed decision-making, economic planning, and contributing to the nation’s fiscal well-being.