Inflation in USA: Navigating Economic Dynamics and Financial Realities

Unveiling the Complexities: Understanding Inflation in USA

Inflation, a pervasive economic phenomenon, holds significant implications for the United States. This article delves into the intricacies of Inflation in USA, exploring its definition, influencing factors, effects on the economy, and considerations for individuals navigating the financial landscape.

Defining Inflation and Its Metrics

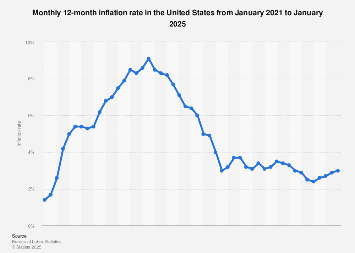

Inflation refers to the general increase in the prices of goods and services over time, leading to a decrease in the purchasing power of a currency. Economists commonly measure inflation through various metrics, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). These indicators provide insights into the overall price movements across different sectors of the economy.

Factors Influencing Inflation

Several factors contribute to the occurrence of inflation in the USA. Demand-pull inflation may result from increased consumer spending, exceeding the available supply of goods and services. Cost-push inflation, on the other hand, occurs when production costs rise, leading businesses to pass on the expenses to consumers. Understanding these dynamics is essential for comprehending the root causes of inflation.

The Role of Monetary Policy

Monetary policy, regulated by the Federal Reserve, plays a crucial role in managing inflation. By adjusting interest rates and implementing open market operations, the Federal Reserve seeks to control inflation and stabilize the economy. Striking a balance between encouraging economic growth and preventing runaway inflation is a delicate task undertaken by policymakers.

Effects of Inflation on the Economy

Inflation can have far-reaching effects on the economy. While moderate inflation is considered normal and even beneficial for stimulating economic activity, hyperinflation or deflation can pose significant challenges. High inflation erodes the value of money, leading to uncertainties for businesses, consumers, and investors. Understanding these effects is crucial for individuals and businesses in making informed financial decisions.

Impact on Consumer Purchasing Power

One of the direct consequences of inflation is its impact on consumer purchasing power. As prices rise, the same amount of money buys fewer goods and services. This can affect the standard of living for individuals, especially those on fixed incomes, and necessitate adjustments in spending and saving habits.

Inflation and Investment Strategies

Inflation also influences investment strategies. Investors seek returns that outpace inflation to preserve and grow their wealth. Understanding the relationship between inflation and various asset classes, such as stocks, bonds, and real estate, is crucial for crafting a diversified investment portfolio that can withstand the erosive effects of inflation.

Wage Dynamics and Employment Considerations

In the context of inflation, wage dynamics come into play. While rising wages can help individuals cope with higher living costs, there may be a lag between wage adjustments and inflation. For employers, managing labor costs amidst inflationary pressures requires strategic considerations. Navigating these dynamics is essential for both employees and employers.

Government Policies and Inflation Management

Governments implement fiscal policies to manage inflation. These policies include taxation, government spending, and budgetary measures. Strategic interventions are necessary to address inflationary or deflationary pressures, striking a balance that fosters economic stability and growth.

Inflation Expectations and Economic Forecasting

Inflation expectations, shaped by consumer and business perceptions, influence economic behavior. Central banks closely monitor these expectations, as they can impact spending, investment, and financial market dynamics. Accurate economic forecasting, considering inflationary pressures, is essential for policymakers, businesses, and investors.

Navigating Inflation in Personal Finance

For individuals navigating the complexities of inflation in their personal finances, understanding its impact is crucial. Strategies such as investing in inflation-protected securities, diversifying investments, and staying informed about economic trends can help individuals safeguard their financial well-being.

Explore Opportunities Amidst Inflation at CareerTH.com

To navigate the financial realities of inflation and explore career opportunities that thrive in dynamic economic environments, visit CareerTH.com. This platform provides insights into industries resilient to inflationary pressures and offers pathways for individuals seeking careers that flourish amidst economic complexities.

Conclusion: Adapting to Economic Realities

In conclusion, Inflation in USA is an economic reality that demands attention and adaptation. Understanding its nuances, effects, and the strategies employed by policymakers and individuals alike is essential for navigating the financial landscape. By staying informed and exploring opportunities on platforms like CareerTH.com, individuals can adapt to the economic realities and build resilient financial futures.