Monetary Mastery: Navigating USA’s Policy Landscape

Monetary Mastery: Navigating USA’s Policy Landscape

Understanding and navigating the intricacies of the USA’s monetary policy is crucial for individuals, businesses, and policymakers alike. This article delves into the foundations, tools, and implications of monetary policy in the United States, shedding light on its impact on economic stability and growth.

Foundations of Monetary Policy

Begin by exploring the foundations of monetary policy. Discuss the roles and responsibilities of the Federal Reserve, the central banking system in the United States. Explain how the Federal Reserve formulates and implements monetary policy to achieve economic objectives such as price stability, maximum employment, and moderate long-term interest rates.

Key Tools of Monetary Policy

Examine the key tools that the Federal Reserve employs to influence the economy. Discuss open market operations, discount rates, and reserve requirements. Explore how adjustments to these tools impact the money supply, interest rates, and overall economic activity. Analyze the intricacies of the Federal Reserve’s decision-making process.

Inflation Targeting and Price Stability

Explore the Federal Reserve’s approach to inflation targeting and maintaining price stability. Discuss the importance of a target inflation rate in fostering economic predictability and consumer confidence. Analyze how the Federal Reserve uses monetary policy to respond to deviations from the target inflation rate.

Interest Rates and Their Impact

Delve into the role of interest rates in monetary policy. Discuss how the Federal Reserve adjusts short-term interest rates to influence borrowing costs, spending, and investment. Explore the impact of interest rate changes on consumer behavior, business decisions, and overall economic growth.

Monetary Policy and Employment Goals

Examine how monetary policy contributes to the Federal Reserve’s employment goals. Discuss the relationship between interest rates, investment, and job creation. Analyze how the Federal Reserve seeks to support maximum sustainable employment while maintaining price stability.

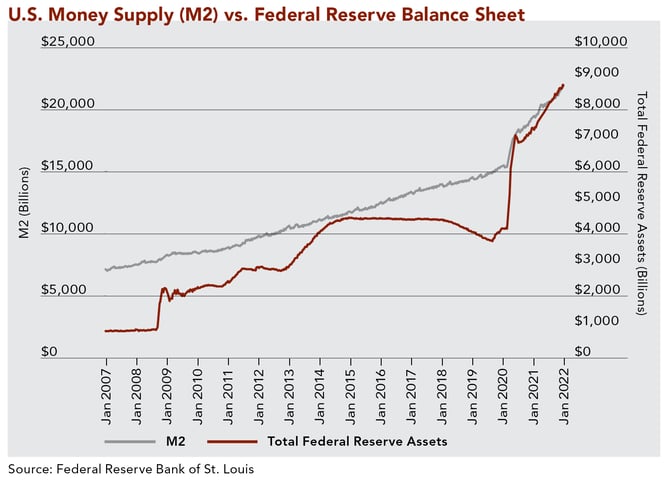

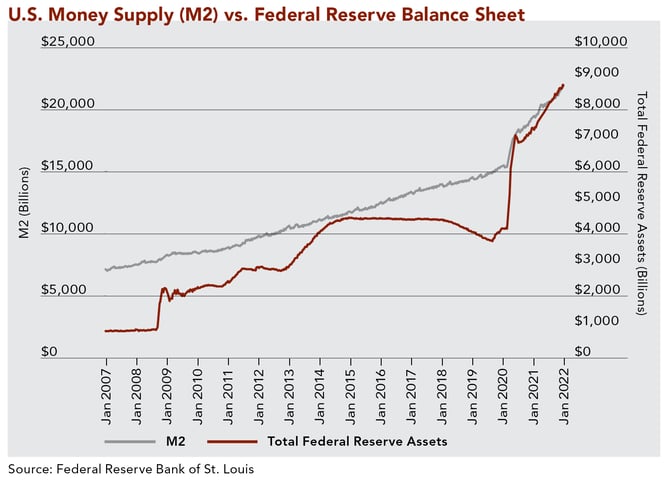

Quantitative Easing and Unconventional Measures

Discuss unconventional monetary policy measures, such as quantitative easing, employed during times of economic crisis. Explore how the Federal Reserve uses these tools to address disruptions in financial markets and stimulate economic activity. Analyze the potential benefits and risks associated with unconventional measures.

Global Impacts and Exchange Rates

Explore the global impacts of US monetary policy. Discuss how changes in interest rates and monetary policy decisions influence global financial markets and exchange rates. Analyze the challenges and considerations the Federal Reserve faces in a globally interconnected economy.

Communication Strategies and Forward Guidance

Examine the importance of effective communication in monetary policy. Discuss how the Federal Reserve communicates its policy decisions to the public, financial markets, and other stakeholders. Explore the role of forward guidance in shaping expectations and influencing economic behavior.

Challenges and Criticisms

Acknowledge the challenges and criticisms associated with monetary policy. Discuss debates around the effectiveness of certain tools, the potential for unintended consequences, and the limitations of monetary policy in addressing structural economic issues. Analyze how the Federal Reserve adapts to evolving economic conditions.

Explore Finance Careers on Careerth

For individuals intrigued by the complexities of monetary policy and its impact on the economy, exploring careers in finance on Careerth can provide valuable insights. The platform offers information on finance-related careers and opportunities to contribute to the financial landscape.

Conclusion

In conclusion, navigating the landscape of USA’s monetary policy requires a nuanced understanding of its foundations, tools, and objectives. Whether you are an individual making financial decisions, a business planning investments, or a policymaker shaping economic strategies, a comprehensive grasp of monetary policy is essential for informed decision-making in the ever-changing economic environment.